BLOGS

MY BLOGS

Opportunity is Calling in the Valley — Are You Ready to Answer?

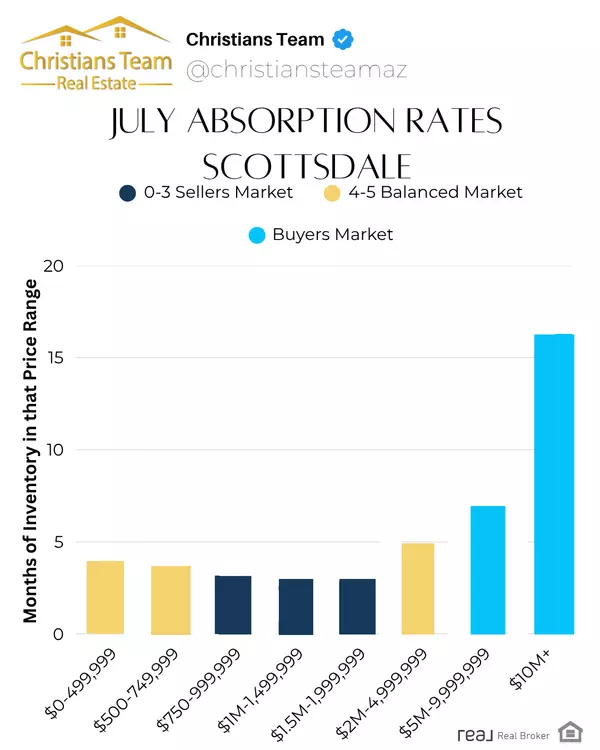

Arizona Real Estate Market Update: July Absorbtion Rates The Arizona housing market is as hot as our summer temperatures—and understanding where each city stands can help you make strategic, profitable moves whether you’re buying or selling. One of the most powerful tools we use to understand market

Read More

Why Now is the Best Time for a 1031 Exchange

Why This Time of Year is Perfect for 1031 Exchanges in Real Estate If you’re thinking about making some moves in real estate, now might be the perfect time to consider a 1031 exchange. This time of year is especially popular for 1031 exchanges, which are a way to swap one property for another witho

Read More

How Low Mortgage Rates Are Shaping Supply and Demand in the Phoenix, Scottsdale, and Mesa Real Estate Market

How Low Mortgage Rates Are Shaping Supply and Demand in the Phoenix, Scottsdale, and Mesa Real Estate Market The Phoenix Valley real estate market, encompassing Scottsdale, Phoenix, and Mesa, is heavily influenced by supply and demand dynamics, with mortgage rates playing a pivotal role. The histori

Read More